FREQUENTLY ASKED QUESTIONS

SPECIFIC TO THE USAGE OF THIS APPLICATION

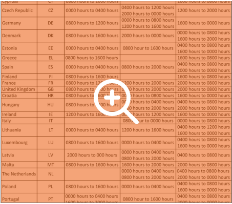

SERVER TRAFFIC - PEAK AND TROUGH TIMINGS AROUND THE CLOCK

This application is built on the VIES validation server, which is physically based in Brussels, Belgium at the centre of the European Union. The VIES validation server acts as a bridge to connect to the local member state servers and validate the VAT ID’s of Intra-community trade operators for good and services within the European Union. It has been observed that VAT ID validation is a regular activity performed by companies who are trading frequently within the European Union. Hence the parameter of server traffic peak and non-peak timings are important, for bulk validation requests, which exactly what this application does for you. Users are therefore advised to take note of the following table, which illustrates the peaks and troughs of the member state VAT server traffic. For example, if your request (input file) has VAT ID’s of a particular member state, one should have a look at the table below to make sure that they are scheduling or launching their validation process at a time slot that not a time of heavy server traffic. At times when the server traffic is heavy, your validation process might take a lot more time than during the low traffic time.

OPERATIONAL FAQ’s

VAT checker is designed for maximum 30k items in one session. Should you need to validate more items we recommend to split your data into more files and schedule the session for night or weekend to avoid heavy traffic at the VIES server.

VAT checker is designed for validation of VAT registrations that can be used for transactions between EU Member States. VAT registrations valid for local transactions within specific states (for example Polish NIP or Spanish NIF cannot be validated by VAT checker at the moment.

Currently only validation of VAT IDs in VIES system is supported. Except for VIES, you can also find on our website several shortcuts to specific validation links of some countries for your convenience.

Some countries such as Spain and Germany do not disclose the legal entity name and address via VIES service therefore such information is not available in the validation output file. Should you need to validate such information, the request has to be sent directly to the tax administration of relevant country.

The requestor VAT ID is required in order to get official consultation number from VIES system which proves the validation was performed.

VAT checker is especially designed for VAT projects such as ERP migration, acquisitions, master data maintenance and depending on your internal processes well supports VAT ID validation in standard VAT compliance cycle. Therefore it is able to identify many situations where the corrective action in your data is needed.

The request time is a value provided by the VIES server at the beginning of bulk validation.

Sometimes there is too heavy traffic on the VIES server which is causing difficulties to validate this number. For the time being we recommend to validate those items again. We are aware of this and will resolve it with next upgrade.

VAT checker is envisaged for processes without real time validation of VAT IDs at the time of invoice creation therefore it is offered as separate on line service. The implementation of real time (billing) VAT ID validation is possible depending on technical complexity of your billing system. Such implementation would be part of separate project.